Introduction: In the ever-evolving economic landscape of India, venture capital firms have emerged as the linchpins of innovation and entrepreneurship. These firms are instrumental in nurturing startups, providing crucial financial backing, and strategic mentorship that goes beyond monetary investment. This guide is an exhaustive list of the top 100 venture capital firms in India, shedding light on their investment strategies, standout portfolio companies, and the transformative impact they have on India's vibrant startup ecosystem.

Methodology: This list has been compiled based on various credible sources and industry reports, considering factors such as the number of investments, the range of portfolio companies, involvement in various funding stages, and overall impact on the startup ecosystem.

The List: (Note: The list below is a condensed version and should ideally include detailed information about each firm. The entries are examples and do not reflect the actual ranking.)

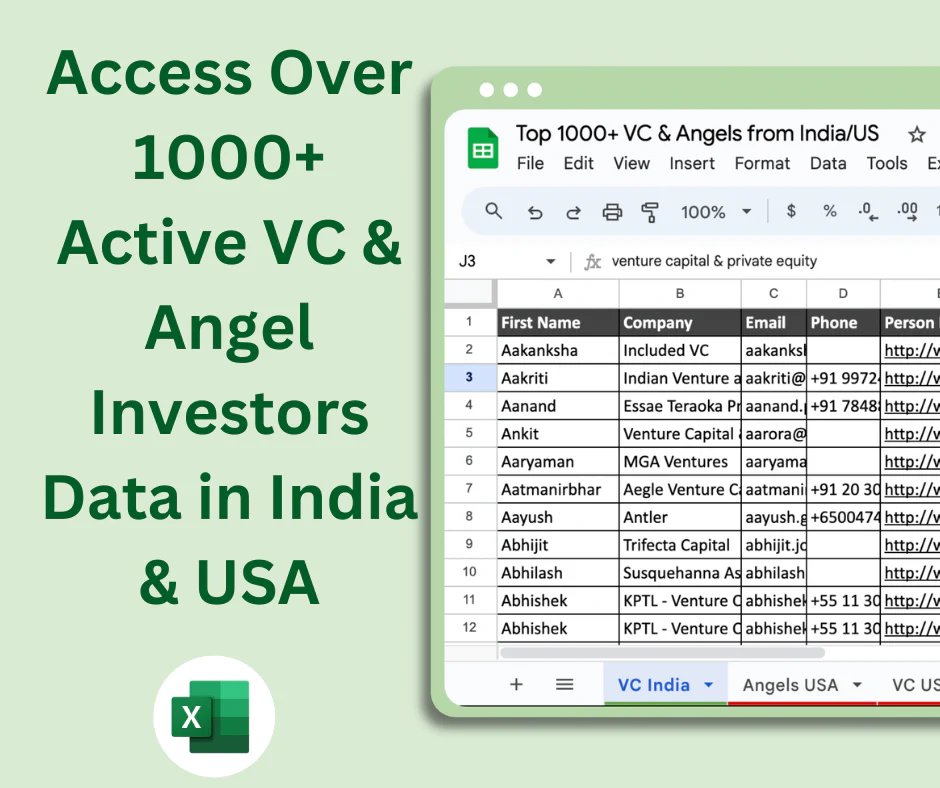

(Why search for every connect and waste month in fund raising,

Get access to 1000+ Top VC and Angels Instantly)

- Antler

- Investment Focus: Antler focuses on building and investing in early-stage startups, turning the world's top talent into great founders of great companies.

- Website: Antler

- Sequoia Capital

- Investment Focus: Technology, Healthcare

- Notable Investments: Bounce, Tabby, Airmeet, Bira

- Website: Sequoia Capital India

- Entrepreneur First

- Investment Focus: Entrepreneur First invests in individuals “pre-company,” helping talented individuals form teams, develop ideas, and accelerate through fundraising from the world's best investors.

- Website: Entrepreneur First

- Indian Angel Network

- Investment Focus: Diverse sectors, early-stage investments

- Notable Investments: Wow! Momo, WebEngage, Druva Software

- Website: Indian Angel Network

- Picus Capital

- Investment Focus: Early-stage technology companies worldwide, with a focus on real estate, finance & insurance, human resources, renewable energy, and education.

- Website: Picus Capital

- Earlybird Venture Capital

- Investment Focus: Diverse sectors, focusing on European technology innovators.

- Website: Earlybird Venture Capital

- DST Global

- Investment Focus: Late-stage global ventures, internet companies.

- Notable Investments: Facebook, Twitter, WhatsApp, Snapchat, Airbnb.

- Website: DST Global

- Included VC

- Investment Focus: Offering an inclusive venture fellowship program, supporting individuals from diverse backgrounds to enter the VC industry.

- Website: Included VC

- Super Capital

- Investment Focus: Early-stage startups, technology companies.

- Website: Information not available.

- ff Venture Capital

- Investment Focus: Early-stage companies, focusing on technical and product-focused founders.

- Website: ff Venture Capital

- Jungle Ventures

- Investment Focus: Consumer internet, media, commerce, and technology businesses in the Asia Pacific.

- Website: Jungle Ventures

- Dallas Venture Capital

- Investment Focus: Early to mid-stage technology companies in the U.S. and India.

- Website: Dallas Venture Capital

- SucSEED Ventures

- Investment Focus: Early-stage startups, technology innovations.

- Website: SucSEED Ventures

- BEENEXT

- Investment Focus: Early-stage tech startups, with a focus on India, Southeast Asia, Japan, and the USA.

- Website: BEENEXT

- DSG Consumer

- Investment Focus: Early-stage investments in the consumer sector.

- Website: DSG Consumer Partners

- Anthill Ventures

- Investment Focus: Speed-scaling early-stage startups through business scaling, corporate market access, and technology optimization.

- Website: Anthill Ventures

- Brand Capital India

- Investment Focus: Strategic investment arm of The Times Group, investing in promising, early-stage businesses.

- Website: Brand Capital

- Jupiter Capital Private Limited

- Investment Focus: Venture capital and private equity, strategic investments.

- Website: Jupiter Capital

- Fireside Ventures

- Investment Focus: Early stage investments in consumer brands.

- Website: Fireside Ventures

- 100X.VC

- Investment Focus: Seed stage investments in startups across sectors.

- Website: 100X.VC

- Trifecta Capital

- Investment Focus: Venture debt, providing structured debt solutions to growth-stage startups.

- Website: Trifecta Capital

- Orios Venture Partners

- Investment Focus: Seed and early-stage startups, technology-focused companies.

- Website: Orios Venture Partners

- Alteria Capital

- Investment Focus: Venture debt, specializing in structured debt financing to growth-stage companies.

- Website: Alteria Capital

- Indian Venture and Alternate Capital Association

- Description: An association representing the interests of the venture capital and private equity industry in India.

- Website: Information not available.

- YourNest Venture Capital

- Investment Focus: Early-stage investments in technology-focused startups.

- Website: YourNest

- Lightbox

- Investment Focus: Early and growth-stage consumer technology companies.

- Website: Lightbox

- SIDBI Venture Capital

- Investment Focus: Investments in small and medium enterprises in India, promoting economic growth.

- Website: SIDBI Venture Capital

- First Cheque

- Investment Focus: First external cheque in pre-seed startups, across sectors.

- Website: First Cheque

- Evolve Ventures

- Investment Focus: Investing in startups with a focus on technology, consumer products, and services.

- Website: Information not available.

- Arise StrongHer Ventures

- Investment Focus: Supporting women entrepreneurs, gender-diverse teams, and startups promoting women's health and employment.

- Website: Information not available.

- Speciale Invest

- Investment Focus: Early-stage venture fund investing in technology startups.

- Website: Speciale Invest

- Inflexor Ventures

- Investment Focus: Technology-focused early-stage ventures.

- Website: Inflexor Ventures

- Ananta Capital

- Investment Focus: Growth-stage investments in technology, consumer, and healthcare sectors.

- Website: Ananta Capital

- Mount Judi Ventures

- Investment Focus: Early-stage technology startups.

- Website: Mount Judi Ventures

- Avaana Capital

- Investment Focus: Early to growth-stage investments in impactful and innovative Indian businesses.

- Website: Avaana Capital

- Avataar Venture Partners

- Investment Focus: Growth-stage B2B and SaaS startups in India and Southeast Asia.

- Website: Avataar Venture Partners

- Lumis Partners

- Investment Focus: Operating and scaling companies through unique co-building models.

- Website: Lumis Partners

- Renaissance Venture Capital

- Investment Focus: Connecting innovation, capital, and expertise to drive growth and value creation.

- Website: Renaissance Venture Capital

- St.Louis Based Venture Capital

- Description: This refers to venture capital firms based in St. Louis, focusing on various sectors and stages of investment.

- Website: Information not available.

- BLinC Invest

- Investment Focus: Early-stage startups, diverse sectors.

- Website: BLinC Invest

- Auxano Capital

- Investment Focus: Growth equity investments in high-potential businesses.

- Website: Auxano Capital

- FortyTwo.VC

- Investment Focus: Pre-seed and seed-stage investments, technology startups.

- Website: FortyTwo.VC

- BAce Capital

- Investment Focus: Early-stage startups, focusing on India and Southeast Asia.

- Website: BAce Capital

- 35 North Ventures

- Investment Focus: Technology startups, early to growth stages.

- Website: Information not available.

- Artha99 Venture Capital Fund

- Investment Focus: Diverse sectors, focusing on early-stage startups.

- Website: Information not available.

- Meraki Labs

- Investment Focus: Early-stage startups, technology innovations.

- Website: Information not available.

- Trucks Venture Capital

- Investment Focus: Early-stage startups in the transportation sector.

- Website: Trucks Venture Capital

- Sparrow Capital

- Investment Focus: Provides capital, network, and expertise to the seed, early, and growth-stage companies.

- Website: Sparrow Capital

- Equitas Capital

- Investment Focus: Customized investment solutions and wealth management.

- Website: Equitas Capital

- Ignis Capital

- Investment Focus: Early-stage investments, technology-focused companies.

- Website: Ignis Capital

- Billionaire Venture Capital

- Description: This could refer to venture capital firms that manage or are backed by billionaire investments.

- Website: Information not available.

- SÍRIUS Venture Capital

- Investment Focus: Diverse sectors, early to mid-stage investments.

- Website: Information not available.

- Veteran Ventures Capital

- Investment Focus: Supporting veteran entrepreneurs and military spouse entrepreneurs.

- Website: Veteran Ventures Capital

- PitchRight Ventures

- Investment Focus: Early-stage startups, diverse sectors.

- Website: Information not available.

- Susquehanna Asia Venture Capital

- Investment Focus: Private equity and venture capital investments in Asia.

- Website: Information not available.

- Sweat Equity Partners India

- Description: This could refer to partnerships where stakeholders contribute to the value of a project or business through work/effort, rather than financial input.

- Website: Information not available.

- FounderBank Capital

- Investment Focus: Specializes in startup financing, providing capital and strategic support to founders.

- Website: FounderBank Capital

- MGA Ventures

- Investment Focus: Early-stage startups, technology companies.

- Website: Information not available.

- Aegle Venture Capital

- Investment Focus: Health and wellness startups, early to growth-stage companies.

- Website: Aegle Venture Capital

- Audacity Venture Capital

- Investment Focus: Supports startups with bold visions, early to mid-stage investments.

- Website: Audacity Venture Capital

- SiO Capital

- Investment Focus: Private equity investments, diverse sectors.

- Website: SiO Capital

- Trillium Venture Capital

- Investment Focus: Early-stage technology startups.

- Website: Trillium Venture Capital

-

Enablers

- Investment Focus: Facilitates funding for startups and SMEs, connecting investors and businesses.

- Website: Enablers

-

MASTERKEY Venture Capital

- Investment Focus: Early-stage startups, technology-focused companies.

- Website: Information not available.

-

Unicorn Venture Capital

- Investment Focus: Supports high-growth startups, aiming to achieve unicorn status.

- Website: Information not available.

-

Pacific Venture Capital

- Investment Focus: Early to growth-stage investments, diverse sectors.

- Website: Information not available.

-

Karnataka Information Technology Venture Capital Fund

- Investment Focus: Information technology and biotechnology sectors in Karnataka.

- Website: KITVEN

-

White Venture Capital

- Investment Focus: Early-stage technology startups.

- Website: Information not available.

-

Founders Sphere Venture Capital

- Investment Focus: Supports innovative startups, early to mid-stage investments.

- Website: Information not available.

-

Indian Academy of Venture Capital

- Description: An educational or training institution focusing on venture capital, private equity, and entrepreneurial finance.

- Website: Information not available.

-

Quantum Angels Venture Capital

- Investment Focus: Early-stage technology companies, focusing on quantum computing and related fields.

- Website: Information not available.

-

Equatorius Capital Group

- Investment Focus: Private equity investments, strategic advisory services.

- Website: Equatorius Capital Group

-

ITLEADERS Venture Capital Company

- Investment Focus: Technology startups, IT innovations.

- Website: Information not available.

-

Openbook VC

- Investment Focus: Early-stage startups, open-source projects.

- Website: Information not available.

-

AAB VENTURE CAPITAL

- Investment Focus: Diverse sectors, early to growth-stage investments.

- Website: Information not available.

-

Frankfurt School Venture Capital

- Investment Focus: Supports startups and innovative projects related to the Frankfurt School community.

- Website: Frankfurt School Venture Capital

-

SCapitalbank

- Description: This could refer to a financial institution providing venture capital or related financial services.

- Website: Information not available.

-

FALCON VENTURE CAPITAL LIMITED

- Investment Focus: Early-stage startups, technology companies.

- Website: Information not available.

-

RJ Venture Capital

- Investment Focus: Diverse sectors, focusing on early-stage startups.

- Website: Information not available.

.....Many more are included here : LINK

Conclusion: The venture capital firms listed are the torchbearers of innovation in India, significantly contributing to the country's economic growth and global standing. As they continue to foster creativity and ingenuity, the future of the Indian startup ecosystem remains bright and on a path of unprecedented growth.

Disclaimer: This article is for informational purposes only. Investment in startups carries risks, including loss of capital, illiquidity, lack of dividends and dilution, and it should be done only as part of a diversified portfolio. Please read the Risk Warning before investing. Data cited in this article is based on various sources and there is no guarantee of its accuracy.